tax return rejected dependent ssn already used turbotax

Has the power to doom this deal like it did. Seamlessly file their taxes through Intuit TurboTax integration and get faster access tCredit Karma the consumer technology platform with more than 110 million members in the US has launched a new tax experience with the goal of taking the stress.

Can You Start Over On Turbotax Techcult

The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

. It goes to a special address. Microsoft describes the CMAs concerns as misplaced and says that. On the next screen select Start next to Step 3 and follow the instructions to e-file your return.

Let us help you turn this into an IRS acceptance. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games. If you subsequently filed a regular return it would get rejected and you would have to file a tax amendment.

8am - 5pm Sat. Credit Karma launches new tax experience to help its members in the US. This website says you qualify for education credit as F-1 student when your parents claim you as dependent on their tax return because they file Form 1040.

Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. Pole dancing classes fort wayne Exclusive. That claim is part of a range of comments given to Eurogamer sister site GamesIndustrybiz in response to the CMAs latest report which otherwise mostly repeats many of the same concerns raised.

Apr 05 2021 Youll file Form 1040 or Form 1040-SR tax return for seniors. Sign in to TurboTax and select File from the menu. Tax deferred income plans.

A footnote in Microsofts submission to the UKs Competition and Markets Authority CMA has let slip the reason behind Call of Dutys absence from the Xbox Game Pass library. That means the impact could spread far beyond the agencys payday lending rule. May not be combined with any other promotion including Free 1040EZ.

If you found out that you claimed a dependent incorrectly on an IRS accepted tax return you will need to file a tax amendment or form 1040-X and remove the dependent from your tax return. They are eligible to receive a total of 6000 composed of 3000 per child dependent. Unless Microsoft is able to satisfy Sonys aggressive demands and appease the CMA it now looks like the UK.

335 PvP healer Druid Paladin Disc Priest and as DPS Mage Rogue DK Shadow Priest Affli Lock are the best choices 335 Tank wise Paladin DK Warrior Bear in that. Following a bumpy launch week that saw frequent server trouble and bloated player queues Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 daysSinc. IRS Letter 105C IRS Letter 106C Partial Claim Disallowance.

The number of American households that were unbanked last year dropped to its lowest level since 2009 a dip due in part to people opening accounts to receive financial assistance during the. MC801 5G router Router 5G ZTE ZTE 5G indoor router MC801A ZTE 5G Router ZTE 5G. At the Were ready to file your.

Wotlk pvp tier listwhat is a. Having to file the gift tax return on Form 709 doesnt mean youll pay gift tax out of. A new client is defined as an individual who did not use HR Block or Block Advisors office services to prepare his or her prior-year tax return.

SignNow has paid close attention to iOS users and developed an application just for them. The holding will call into question many other regulations that protect consumers with respect to credit cards bank accounts mortgage loans debt collection credit reports and identity theft tweeted Chris Peterson a former enforcement attorney at the CFPB who is now a law. Dont select Fix my return youve already done that.

Hopefully tax return processing for the 2023 tax season will be much improved and in line with the schedule shown below given increased IRS funding and no new stimulus programs to administer. With each qualifying dependent claimed on a tax return eligible for an additional 1400 payment. The 2022 tax season was a bumpy one with many tax filers reporting delayed refund payments due to IRS backlogs and processing delays.

If you contact the IRS or try to look up your return or refund status on their site while your return is in Pending status dont be alarmed if they. The typical consumer-grade tax software packages such as TurboTax and HR Block software dont support filling out the gift tax return. The University of Tennessee at Chattanooga offers a competitive employee benefits package that includes holiday annual vacation sick bereavement court and military leave.

If you had entered 2800 as the amount you already received Turbotax would have subtracted that from the rebate and claimed zero on line 30. But the Xbox maker has exhausted the number of different ways it has already promised to play nice with PlayStation especially with regards to the exclusivity of future Call of Duty titles. E-File Your Current and.

Educational benefits for employee spouse and dependents. Dismantle is a strong PvP talent that allows. Modem ini menggunakan WEB UI yang di sertai fitur USSD sehingga anda dapat mengecek pulsa dan sisa quotaZte Mf920v Vs Huawei E5573.

Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off. On the Welcome back screen select Continue. 7 hours ago Best class of Wotlk - Warmane.

Paladin Best Pvp Classes Wotlk XpCourse Free Online Courses. Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles. Why is my e-filed tax return in Pending status and the IRS has no record of my tax returnTurboTax experts say that after e-filing your federal return may sit in Pending status 24-48 hours before its processing status changes.

Amend a return E-file rejects Print or save Tax refunds Tax return status. They have already filed their 2020 return and claimed these dependents thus the IRS used this to automatically issue advance payments of this. Youll have to go to a tax professional or fill out the gift tax return on your own.

We are advancing aviation building smarter. Watch videos to learn about everything TurboTax from tax forms and credits to installation and printing. Feb 12 2020 If you plan to use your Netspend card as your regular form of payment youre better served with the card atop this list.

Microsofts Activision Blizzard deal is key to the companys mobile gaming efforts. To do this with TurboTax CDDesktop. Basic medical and life insurance.

The dependent must have a valid SSN to qualify to get 1400. Download All SCHEMATIC AND SVC Files ZTE MC801ADate. Open TurboTax and select File from the menu.

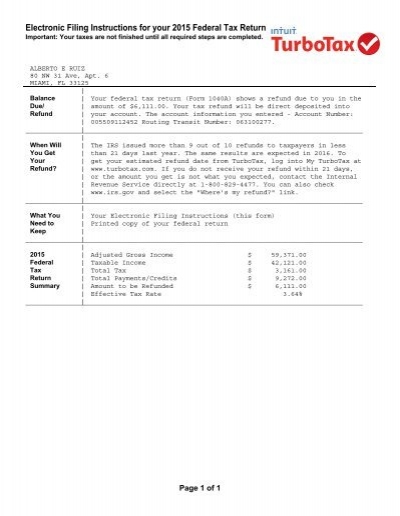

2015 Ruiz A Form 1040 Individual Tax Return Records

Tax Return Rejection Codes By Irs And State How To Re File

Video What To Do If Your Tax Return Is Rejected By The Irs Turbotax Tax Tips Videos

How To Fix Your Dependent S Social Security Number Mismatch E File Reject Turbotax Support Video Youtube

Common Irs Where S My Refund Questions And Errors 2022 Update

Why Was My Tax Return Rejected Primary Causes Explained

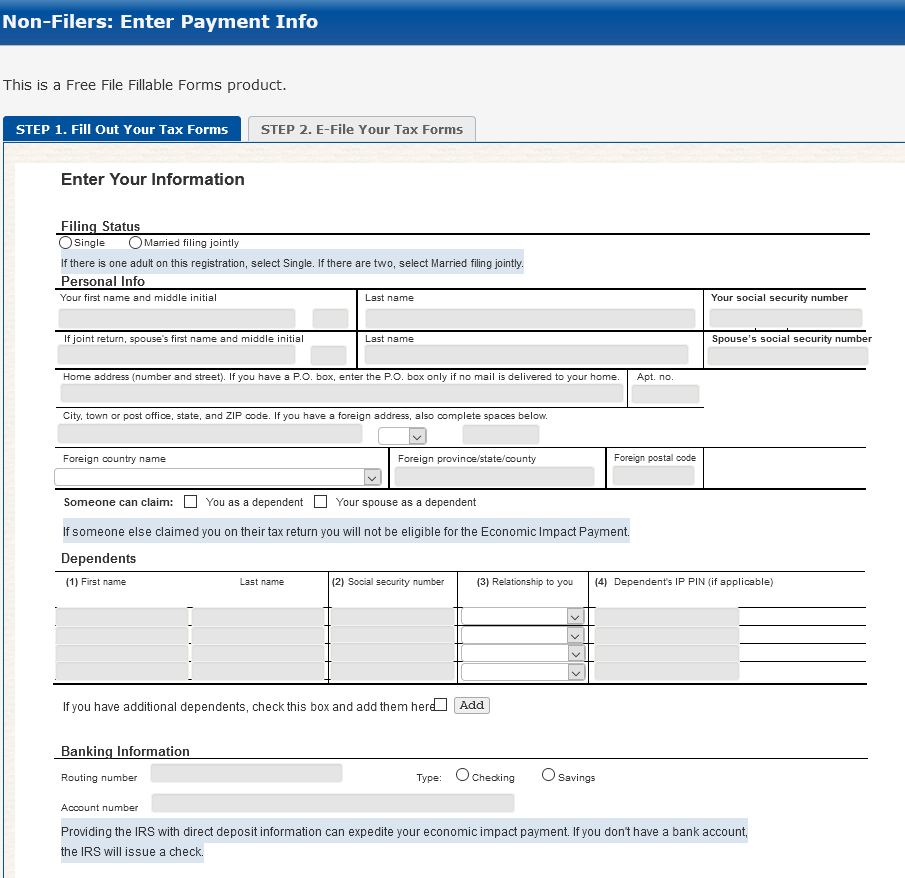

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

Our Tax Return Got Rejected Because Our Deceased Infant Son S Social Security Number Had Already Been Filed R Adviceanimals

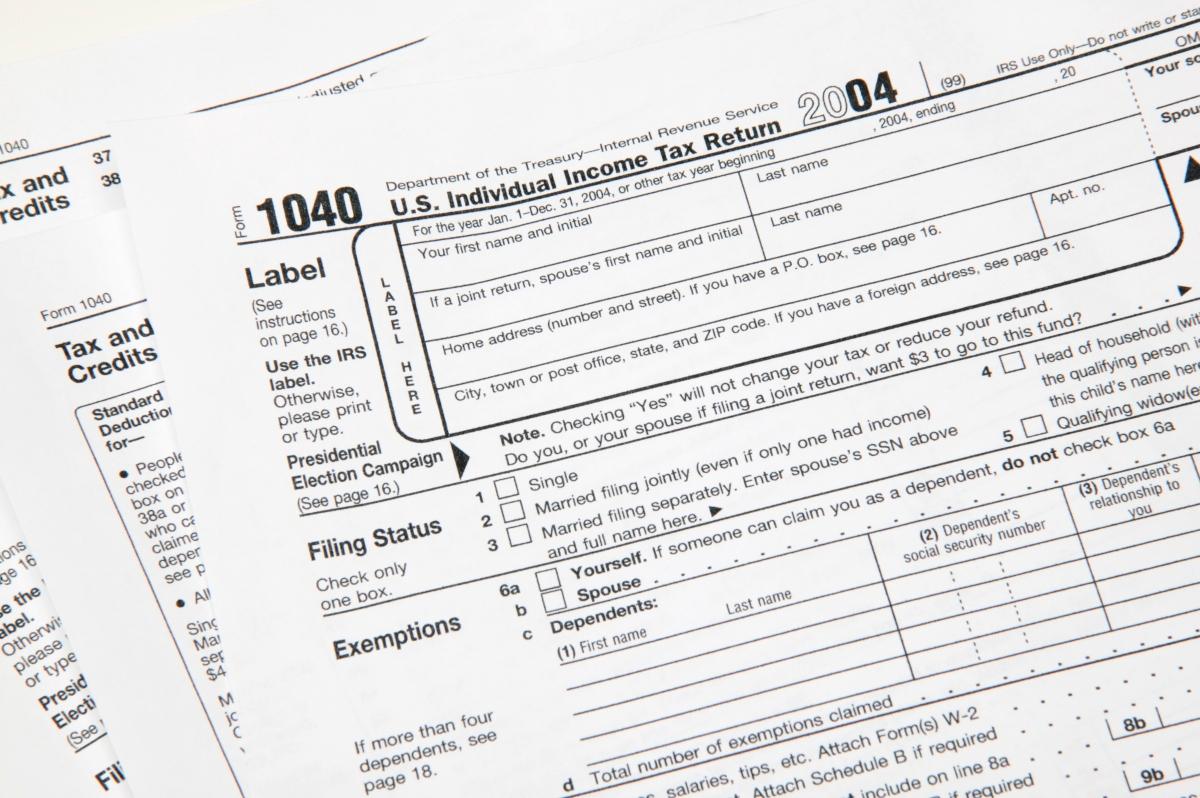

3 11 3 Individual Income Tax Returns Internal Revenue Service

Solved Can Turbo Tax Complete A Form 8962 For Me

Ca State Tax Always Got Rejected Even Turbotax Checked And Said No Error Tried At Least 8 Times Already

Identity Theft What To Do If Someone Has Already Filed Taxes Using Your Social Security Number Turbotax Tax Tips Videos

Downloadfile 30 Pdf Pdf Irs Tax Forms Social Security United States

Tax Refund Stimulus Help I M A 23 Year Recent College Graduate Who Stupidly Applied For Stimulus Check And Later Deleted My Application From The Irs Website Because When M Facebook

Irs Where S My Refund Refund Status Reference Error Codes

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

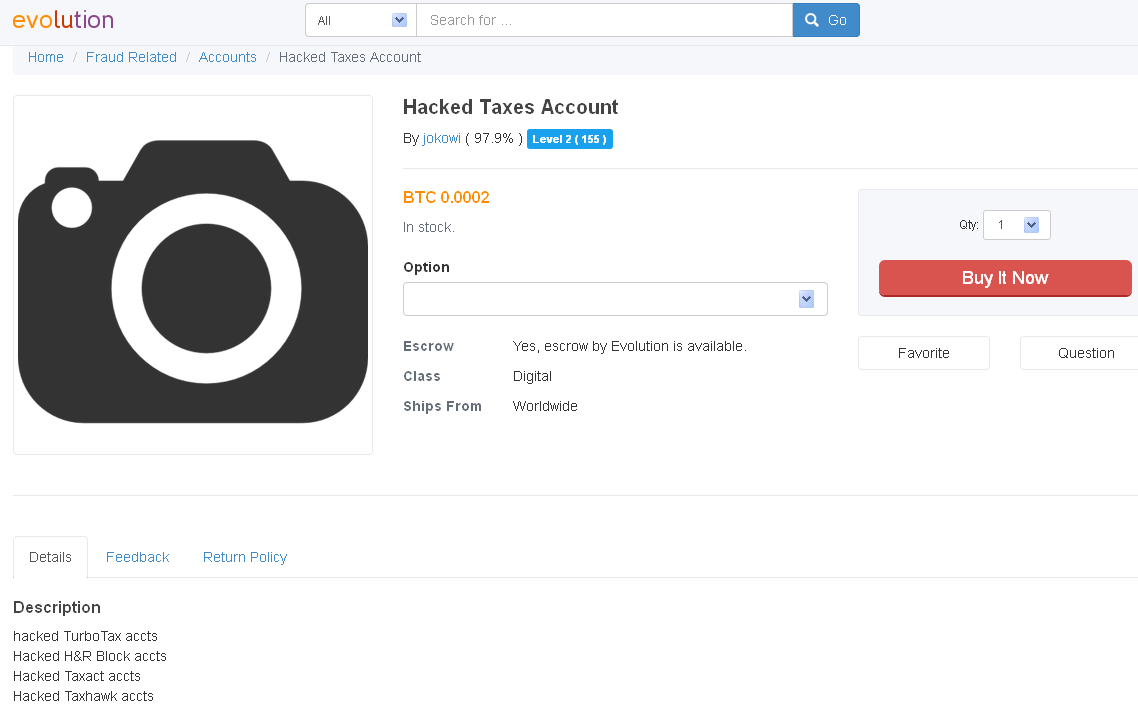

Citing Tax Fraud Spike Turbotax Suspends State E Filings Krebs On Security

Beware The Ides Of February Your Identity Has Been Stolen David Boles Blogs

How To Fix Your Dependent S Social Security Number Mismatch E File Reject Turbotax Support Video Youtube